Design and Development of a Risk Identification and Analysis Tool (RIAT) for Australian Public-Private Partnership Infrastructure Projects- Juniper Publishers

Juniper Publishers- Journal of Civil Engineering

Introduction

The recent history of failed and inefficient

Public-Private Partnership (PPP) infrastructure projects across

Australia, due to their inappropriate risk identification and analysis,

suggests the need to rethink a more appropriate and robust mechanism

that not only quantifies the risk but also selects the optimal

allocation of risk for all participants involved in a PPP project

Australian Infrastructure Plan [1].

Past studies and research have identified the need to improve the

quality of decision making in PPP projects. The variability of risk

management processes and the lack of lucid and systematic practices

towards risk analysis and allocation have often proved to be the

downfall of PPP projects in Australia Fischer [2].

The research aims to design and develop a

computerized Risk Identification and Analysis Tool using Visual Basics

Application (VBA) that would assist stakeholders of PPP's in

appropriately assessing and quantifying the risks inherent to such

projects. The desired ultimate outcome is the enhancement of the

capability and accuracy of the decision-making process in PPP projects.

Methodology

Figure 1

illustrates the methodology employed during this research

investigation. Figure1 Summary of Research Methodology. The researchers

have identified 33 risk factors (RFs) as being significant in

influencing the success of a PPP projects. A list of over 2000 potential

survey respondents was then constructed based on the core project

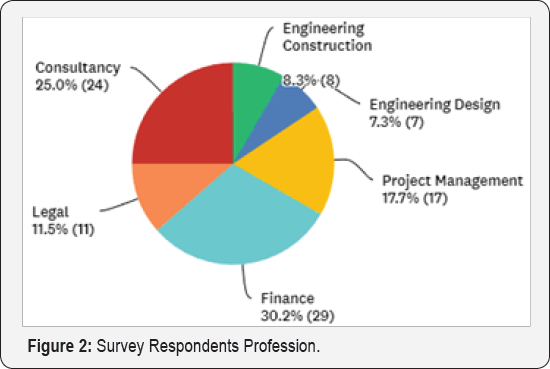

stages of a PPP Project. The survey targeted industry professionals from

both the public and private sector with relevant experience in PPPs

ranging from: site engineers, project managers, legal and finance

experts, consultants and public agents (Figure 2)-such

as various state treasury departments and Federal Ministers. The Delphi

survey asked for respondents to rank the initial 33 RFs separately for

likelihood and severity on a 1-5Likert scale (with 1 = very low / no

influence to 5 = almost certain / catastrophic influence).

Data Analysis

A suite of mathematical functions was then

subsequently applied to the survey results. These included Factor

Analysis and Fuzzy Synthetic Evaluation. Factor Analysis is a common yet

powerful mathematical process whereby a relatively small number of

factors can be determined to represent a larger sample size Norusis [3].

Such an analysis comes in many forms such as common factor analysis,

image factoring, maximum likelihood method and Alfa factoring, however

for this research investigation Principal Components Analysis (PCA) has

been used due to its appropriateness for use in conjunction with Delphi

Studies Yazdani-Chamzini 2014. Some critical assumptions that underpin

such a method include a 1:5 ratio for variables to cases, some

correlation between factors, a linear relationship between the

variables, and the removal of outliers Lingard and Rowlinson[4] . This factor analysis further reduced the factors to key critical risk factor groups (CRFGs).

Fuzzy Set Theory (FST) is useful in situations where

the inputs into a system are "fuzzy", ill-defined or subjective in

nature, but the outputs must be clear and objective Chan et al.c.[5]

. For this research investigation, the inherent nature of the data

collected is subjective as it is based on the independent assessment of

the industry professionals surveyed; hence Fuzzy Set Theory was deemed

appropriate. Fuzzy Synthetic Evaluation (FSE) is commonly used in

various risk management applications, as it is capable of synthetically

evaluating 'an object relative to an objective in a fuzzy decision

environment with multiple criteria' Zhao et al. [6].

The ability to deal with multiple qualities and components is a key

advantage of FSE in assisting with complicated decision making and

evaluations Mu et al. [7].

In this research FSE allows for the risk profile of PPP projects to be

determined, utilising three levels of risk: critical risk factors, risk

groups, and overall risk. This method will require the following

components:

a) A family of factors, where m is the number of factors: E= {Ci, 2, C3 }

b) A set of alternatives:E={e1,2e3,_,en}

c) And an evaluation matrix: R= (rij) , where rijdenotes the degree to which ej satisfies the factor ci

VBA Model

The above process and resulting risk evaluation

analysis tool was then computerised and automated through the

utilisation of Excel with VBA. Excel was deemed an appropriate due to

its widespread utilisation across the industry and ability to establish

an easy to use interface. The end-user can input their subjective risk

evaluations for a PPP project, and the expert intelligent system will

produce a quantitative analysis of the overall risk level of the project

and identify the key RFs that will need mitigating, as balanced against

the expert opinion bank and end user expertise.

Results and Discussion

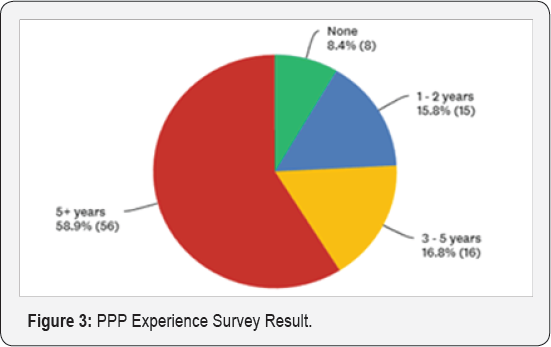

The online survey was closed after approximately 3

months with a total of 96 conforming responses gathered, with 76% of the

respondents from the private sector and 79% with over 10 years'

experience in the industry. Figure 3

below illustrates the breakdown of the respondents’ PPP experience. The

bank of survey responses was analysed and any outliers removed. The

subsequent mean scores of each RF in terms of its the probability of

occurrence and severity were calculated using:

Where: f = frequency of each rating (1-5) for each

RF, s = corresponding score given to each RF and N = total number of

survey responses for a specific RF. The subsequent impact (Risk impact =

-/(Probability x Severity) and thus ranking for each RF was determined

using normalisation, with RF values greater than 0.5 being classified as

critical risk factors (CRFs). 12 CRFs were identified with the top

three observed as:

a. Delays in construction/completion

b. Construction cost overruns and

c.Demand forecasting risks

Factor analysis utilising factor extraction with Vari

max rotation and Kaiser Normalisation was performed using Statistical

Package for Social Sciences (SPSS). The data was tested for

appropriateness using Kaiser-Meyer-Olkin (KMO) and supported with

Bartlett's Test of Sphericity. As the KMO factor (0.814) was greater

than 0.5 the factor analysis performed acceptable.

The four Critical Risk Factor Groups (CRFGs) observed were:

1) construction and operation risks

2) financing/consortium risks

3) political risks and

4) market risks

Each of the 12 CRFs fitted into one of the above CRGs

and the subsequent weightings of each CRF was calculated on a weighted

average of the mean scores. For each specific CRF the membership

function was formed as a part of the FSE. For example, the demand

forecasting RF for severity of occurrence was; 7% scored it very low,

19% as low, 35% as moderate, 32% as high and 7% as very high, as a

result the membership function level 3 was expressed as (0.07, 0.19,

0.35, 0.32, 0.7). The same was generated for the probability of

occurrence [(0.14, 0.27, 0.41, 0.14, 0.04)]. To obtain membership

function level 2 the individual weighting of each CRF was multiplied and

summed by its corresponding linguistic variable (very low (1)-very

high(5) ). This process was repeated to form the overall risk index

(level 1), but instead the CRFG weightings were used.

A VBA interface (Figure 4)

was created to allow the end user to input their project specific

details, such as: size, location and type of PPP and the extent to which

they would like to weight their judgement and the survey data bank

results. The output page illustrates the overall risk levels for each of

the CRGS as well as the quantified risk level of the project on a 1-5

scale.

Conclusion

This research investigation presents a Fuzzy

Synthetic Analysis approach to establishing a quantitative, hands-on and

user-friendly tool based on subjective experts' beliefs sourced from

leading Australian PPP professionals. In doing so this research allows

industry practitioners, be it public or private, to better identify and

assess the risk level of a PPP project based on objective results rather

than subjective judgement. Future works in this area would focus on

developing a system that updates the expert opinions continually as well

as encompassing allocation of risk to the relevant party's as a means

of further developing the tool.

For More Open Access Journals Please Click on: Juniper Publishers

Fore More Articles Please Visit: Civil Engineering Research Journal

Comments

Post a Comment